Stablecoin Evaluation Framework

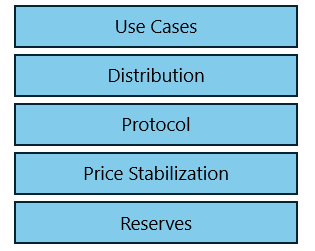

Having studied numerous stablecoins - both successful projects and notable failures - I’ve developed a broad framework to evaluate any stablecoin project. This framework examines five core components and governance.

1. Reserve Management

The foundation of any stablecoin is its reserve management system. The primary goal here is to ensure ensure liquidity and maintain user trust in the currency through effective operational practices.

Evaluation of a stablecoin’s reserves must include examining the composition of assets (whether fiat, crypto, T-bills, or other instruments) and assessing how these assets are managed to maintain liquidity. Equally important are the transparency mechanisms, (such as regular audits and third-party attestations), and the custodial structures that govern reserve access and provide bankruptcy protection.

2. Price Stability:

Price stability represents the core promise of any stablecoin. The primary objective is to maintain the target peg consistently across all market conditions.

This requires careful examination of the peg mechanism itself (whether it’s a simple 1:1 backing, an algorithmic system, or a hybrid approach) and the arbitrage mechanisms that help maintain the peg as the stablecoin is traded on exchanges. The effectiveness of these systems should be evaluated through historical performance data and stress testing.

3. Protocol

The protocol layer, through smart contracts, provides the technical foundation for all stablecoin operations. Its goal is to provide secure, efficient, and scalable infrastructure for all stablecoin functions.

Key protocol considerations include the minting and burning mechanisms, fee structures, and technical architecture. The evaluation should cover code structure, upgrade mechanisms, security measures, performance metrics, and interoperability capabilities.

4. Distribution

Distribution mechanisms determine how the stablecoin flows through the ecosystem. The goal is to ensure efficient management and monitoring of stablecoin circulation.

This includes assessing exchange coverage, geographical reach, and secondary market dynamics. A resilient distribution system should ensure preservation of the fundamentals (price stability, liquidity, etc.).

5. Use Cases

The ultimate measure of a stablecoin’s success is its utility in real-world applications. Common use cases include yield farming, portfolio diversification, payments, and cross-border transactions. The breadth and depth of use cases often indicate the stablecoin’s long-term sustainability.

Governance (Cross-cutting)

Governance frameworks underpin all aspects of stablecoin operation, from reserve management to use case development. These frameworks must clearly define:

- Decision-making authority: Whether decisions are made by the team, the community, or both

- Implementation mechanisms: How decisions are executed, whether through direct team action or programmatically through smart contracts

- Contextual variations: How governance adapts to different situations, including emergency measures and veto powers

Read: Governance Framework for DebtCoin - a stablecoin I’ve envisioned

Conclusion

This framework provides a structured approach to evaluating stablecoins. A robust project should demonstrate strength across all these areas to ensure long-term sustainability and user trust. Careful evaluation of each component helps identify potential risks and assess the overall viability of a stablecoin project.