Redefining Payments: A Smarter Future for Merchants and Consumers

Today’s payment system is bloated and dominated by entrenched interests. This article proposes a crypto-based framework to eliminate banks and payment networks as intermediaries, solving issues like high interchange fees that burden merchants.

Current System Challenges

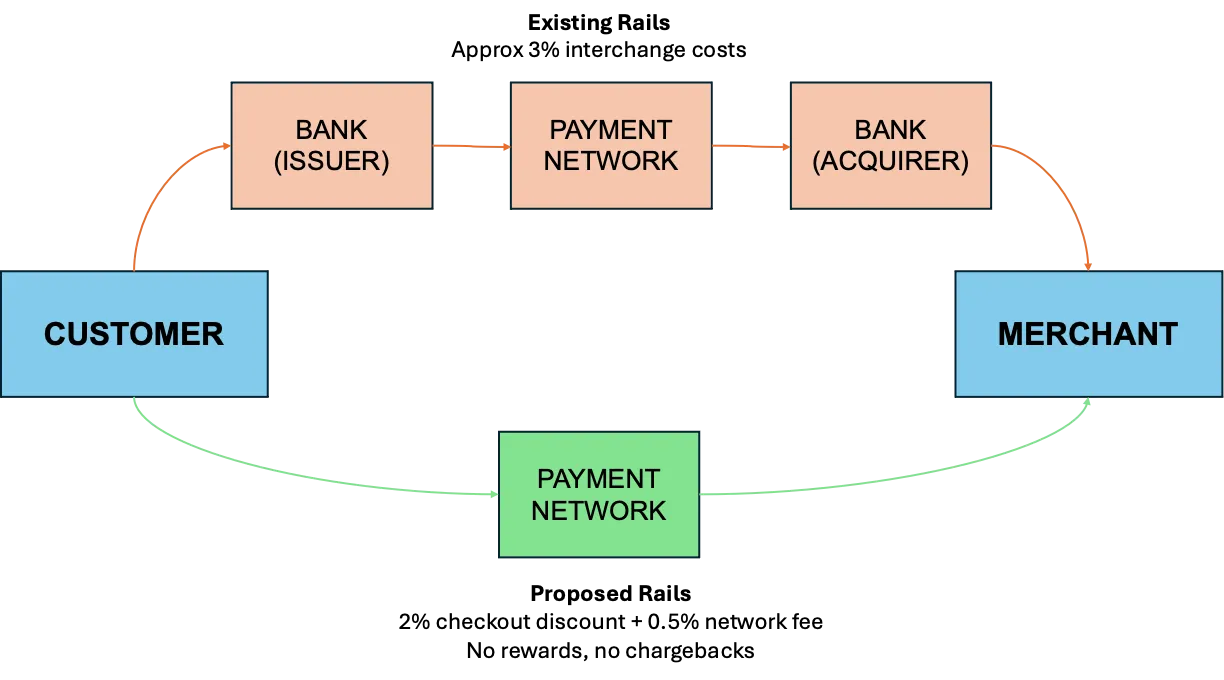

Users today obtain credit/debit cards from “issuing banks” who partner with payment networks (e.g., Visa, Amex). Merchants receive funds through “acquiring” banks. Banks and payment networks control liquidity and money flow, making the system vulnerable to censorship, inefficiency, and privacy risks.

The structure is sustained by a convoluted web of interchange fees and reward programs, which disadvantage merchants. Existing cryptocurrency systems, while effective for P2P payments, lack widespread adoption due to usability challenges.

Proposed Solution

The proposed system leverages cryptocurrency for direct payments. Users get immediate discounts at checkout for using crypto, bypassing interchange fees and card rewards. Merchants pay a 0.5% network fee, while users enjoy a flat 2% “checkout discount”.

Merchants currently pay around 3% in fees plus costs from fraud and chargebacks. The new system eliminates these inefficiencies. The proposed system will need to acquire both users and merchants, similar to Amex or Discover models.

Implementation

Authentication: The system verifies user account balances. If funds are available, the merchant is authorized to complete the sale. Chargebacks will not be supported for operational efficiency. Users will use a QR code, PIN, or phone locks for security.

Sale: The system benefits merchants with no interchange fees, no chargebacks, and reduced costs. User adoption may take time as cardholders are used to rewards programs. Efforts such as the Payment Card Interchange Fee Settlement provide a framework for advocating merchant-friendly policies.

Clearing and Settlement: Settlements will occur in daily batches. This ensures faster processing and eliminates chargeback risks.

Currency: Stablecoins can address volatility concerns. Same-day clearing and fiat conversion will incentivize merchant adoption. Delta-zero stablecoins could be explored in the long term.

Challenges

Adoption requires overcoming entrenched habits, trust issues, and evolving regulations. Fraud and lack of chargebacks may deter users. Legacy players might lower interchange fees to compete.

Future Vision

The rollout will prioritize small businesses and POS payments. An open ecosystem for merchant tools will drive innovation. P2P loans could expand the model to include credit. A fixed 2% discount will attract users, giving this system a competitive edge.

Finally, raising awareness of high-reward cards’ unfair impacts can promote a more equitable payment system.